SustainAdvisory’s analysis of the Green, Social and Sustainable (GSS) bond market in Italy shows a modest 7% of ‘Green Buildings’ (‘GB’) among the eligible projects categories indicated in the use of proceeds of the bond documentation and only 5.9% in terms of volumes issued and allocated to GB assets. Total GSS’ outstanding debt volumes issued by Italian entities and listed on the Italian Stock Exchange as of the end of July 2021 amounted to EUR44.8bn: 60% of those volumes are labeled as ‘Green’, 8.5% as ‘Social’ and 31.5% as ‘Sustainable’ or ‘Sustainability-linked’ bonds.

(Green, Social and Sustainability bonds in the Italian market – Sustain Advisory)

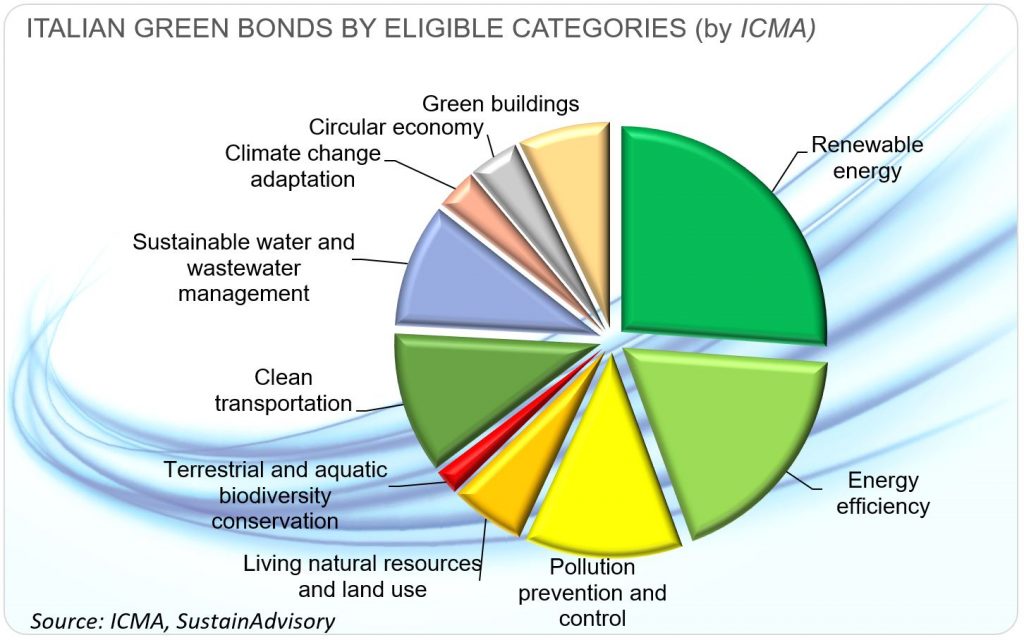

The Italian green bond market is largely dominated by utilities and infrastructure companies: the most frequent eligible project categories cited within the use of proceeds’ description are Renewable Energy (26%), Energy Efficiency (18%), Pollution Prevention and Control (12%) and Clean Transportation (11%), while the Green Buildings category is cited only in 7% of the cases. In terms of volumes issued only EUR2.6bn of the Green Bond issuances was allocated to the Green Building category that is equivalent to 10% of ‘Green’ labeled bonds, and 5.9% of total GSS bonds volume issued.

According to ICMA’s Green Bond Principles (‘GBP’), the proceeds of a bond that is defined ‘green’ shall be used for the funding of eligible green projects, i.e. for projects that provide clear environmental benefits, which are assessed and quantified by the issuer. The list of eligible green projects[1], that ICMA defines as not exhaustive or limited, includes the ‘Green Buildings’ category described as those buildings that meet regional, national or internationally recognized standards or certifications[2] for environmental performance. Furthermore, once identified the project category, the issuer shall commit to specific and measurable targets of energy, water and waste management efficiency and savings and report on the achievement of those targets on an annual basis and until the full allocation of the bond proceeds is completed.

Green Buildings Contribution to Net Zero Target

The building construction ecosystem, including construction materials and buildings management, accounts for 36% of total global GHG emissions; therefore, energy efficiency of new asset developments and decarbonisation of existing buildings is, together with the financing of the oil&gas sector, the main area of focus for banks, investors and operators under international soft law commitments like the Science Based Targets initiative and the Net-Zero pledge.

In Northern European countries, notably Sweden, Belgium, UK, Germany, green bonds are largely used in the real estate sector both for renovation projects as well as new asset developments in the residential and commercial segments. Investors behind the largest projects are tier one pension funds and insurance companies with strong ESG commitments and integrated investment policies in advanced stages of implementation of sustainability strategies and are generally signatories to Net Zero pledge initiatives.

Italian Issuers

In Italy the ‘Green Building’ category has been used in the green bonds issued by financial institutions (Unicredit, Banca Intesa, Banca Popolare di Sondrio, Mediobanca) and insurance companies (Generali and Unipol). Generali, Unicredit and Banca Intesa are also signatories of the Net-Zero pledge through the industries-led Net Zero Alliances of Insurance and Banking respectively.

Insurance companies with direct real estate asset management exposure tend to allocate bonds’ proceeds exclusively to acquisitions of green buildings or to upgrading (retrofitting/renovating) existing assets in portfolio; this is the case for Generali Real Estate, a subsidiary of the Generali group, that has policies for green buildings and green leases, aiming to improve the environmental performance of the company’s real estate assets, which has resulted in an increased number of certified green buildings. Generali group is the largest issuer of green bonds allocated to the ‘Green Building’ category with a total of EUR1.2bn of allocated proceeds from bonds issued in 2019 and 2020.

In the case of financial institutions, proceeds of the bonds are allocated not only to the acquisition, financing or refinancing of real estate assets, but also to the funding of loans / mortgages to retail customers and, most recently, to monetize tax credits linked to public subsidies for energy efficiency works (known as Superbonus, Ecobonus), or earthquake risk reduction on existing buildings (Sismic bonus) of private individuals (not businesses) and apartment blocks. Intesa San Paolo is the second largest issuer of green bonds allocated to ‘Green Buildings’ with EUR940m of allocated proceeds from a bond issued in March 2021.

Certifications

According to ICMA’s Green Bond Principles the issuer of a green bond within the Green Building category shall commit to specific and measurable impacts indicators of energy, carbon, water and waste performances or to internationally recognized standards or certifications for environmental performance. Certifications, in lieu of absolute indicators, are mostly commonly used by Italian issuers. The most popular are LEED, BREEAM and EPC. However, certifications are not always equivalent in terms of performance thresholds and labeling systems; furthermore, national standards across the European Union member countries are established through different schemes and do not represent the same level of efficiency ambition.

With the introduction of the European Green Bonds Standards supported by the EU Taxonomy, indicators will be more homogenous and comparable. The current wording of the Taxonomy proposes a system where absolute thresholds (for operational primary energy as well as operational and embodied GHG emissions metrics) should be set, as a minimum, at the level of performance corresponding to the top 15% of the local building stock in the case of acquisition and ownership of the buildings, while in case of building renovation thresholds are held leads to a reduction of primary energy demand of at least 30 %.

Outlook

The Italian real estate and building construction sector shows space for opportunities driven not only by a prospective growth in GDP of the country but also thanks to the increasing perception of the new market paradigm: the decarbonization of the real estate economy is a de-risking strategy that banks, and insurance companies will progressively need to address, but also one the biggest business opportunities of the next decade. Innovative capital markets solutions and alternative insurance schemes together with public policy supports can play a critical role in reshaping the Italian real estate economy.

Francesca Fraulo is Partner of SustainAdvisory and responsible for ESG Advisory and for the origination of External Reviews services for green, social and sustainable bonds. In 2020 she obtained the certification of GRI Standards. In over 20 years of experience in the rating and capital markets sector, Francesca has been Director for Fitch Ratings, Managing Director of Operations at CRIF Ratings and Senior Consultant for Euler Hermes Ratings.

[1] ICMA list of Eligible Green Categories: Renewable energy; Energy efficiency; Pollution prevention and control; Environmentally sustainable management of living natural resources and land use; Terrestrial and aquatic biodiversity conservation; Clean transportation; Sustainable water and wastewater management; Climate change adaptation; Circular economy adapted products, production technologies and processes; circular tools and services; and/or certified eco-efficient products; Green buildings.

[2] ICMA’s recognized standards or certifications include among other: LEED (Leadership in Energy and Environmental Design), BREEAM (Building Research Establishment Environmental Assessment Method), CEEQUAL, DGNB, EDGE, National Minimum Requirements for Energy Efficiency in Buildings in EU states (based on the EU Energy Efficiency Directive) and Energy Performance Certificates (EPCs), or national certification schemes.