In this paper SustainAdvisory presents findings on the green, social and sustainable (GSS) bond market in Italy, from the perspective of objectives, competitiveness, tenor and transparency of instruments. The research is based on instruments listed on the Italian Stock Exchange (Borsa Italiana) as of the end of July 2021, when cumulative outstanding issuances by Italian entities amounted to EUR44.8bn, for a total of 69 instruments. [1]

[1] For a detailed analysis of volumes, issuers type and an evaluation of the drivers of future growth see: Green, Social and Sustainability bonds in the Italian market – Sustain Advisory.

Most Frequently Referenced SDGs

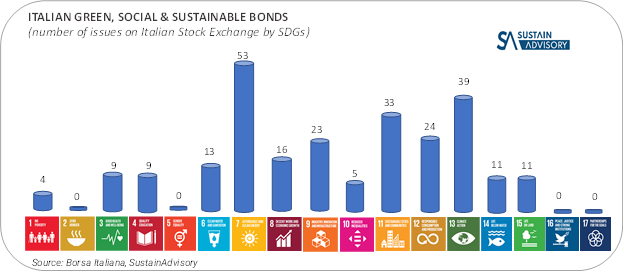

A good number of objectives that green, social and sustainability bonds promote are also the central objectives of the seventeen UN Sustainable Development Goals (SDGs); it is therefore very common that SDGs are referenced in the sustainability strategy of issuers as a contribution towards specific sustainability targets. In the chart below we show the SDGs (from #1 to #17) reported as strategic objectives by Italian issuers.

As ‘green’ is the dominant theme of Italian bond issues and utilities the most frequent issuers, it is no surprise that the most frequently referenced SDGs are those correlated to environmental benefits contributing to the mitigation of and or adaptation to climate change. SDG7 (Affordable and Clean Energy) is in absolute terms the most referenced goal, present in 53 out of 69 bonds (equal to 76% of bonds issued), followed by SDG13 (Climate Action) present in 39 bonds and SDG11 (Sustainable Cities and Communities) with 33 bonds. It should be noted that for each bond several goals are generally referenced, as the use of proceeds can be applied to a variety of investments, or a single investment can serve the purpose of multiple sustainable goals. SDG7 and SDG13 are referenced together in 35 bonds as Clean Energy projects are often correlated to the Climate Actions of climate mitigation and adaptation.

The use of social bonds in response to COVID-19 pandemic has expanded the investments universe to mitigate negative social impacts and contribute to achieve Sustainable Development Goals: SDG3 (Good Health and Well Being), SDG4 (Quality Education), SDG6 (Water and Sanitation), SDG8 (Decent Work and Economic Growth) and SDG10 (Reduced Inequalities) are goals potentially contributing to mitigate the negative impacts resulting from the spread of the pandemic and therefore present in social bonds. The most frequent of these goals is SDG6 (Water and Sanitation) present in 13 bonds and directly correlated to the need to secure sustainable access to freshwater resources and sanitation for all, to succeed in the fight against the corona virus pandemic.

Quite plausible for a developed economy like Italy’s, the absence of bonds directed to SDG2 (Zero Hunger) contributing to achieving food security and good nutrition. The same applies to SDG16 (Peace, Justice and Strong Institutions) and SDG17 (Partnerships for the Goals) that are typically found in bonds issued by sovereign or supranational agencies (i.e. World Bank). A notable absence from the Italian issuers’ goals is SDG5 (Gender Equality) to contribute towards the empowerment of women and girls.

Highly Competitive Instruments

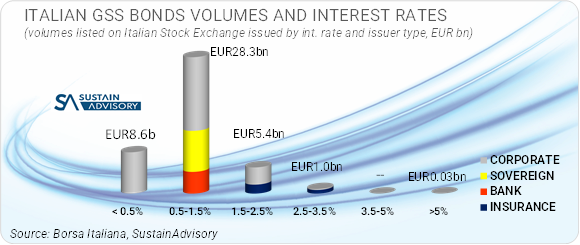

Interest rates’ benefit for GSS debt originates from the market dynamic of a higher demand against the lower available offer. This trend is likely to continue as the number of asset managers with a ‘sustainability’ mandate is increasing at an incredibly fast pace. For individual issuers the market recognizes a trading premium for GSS bonds versus Plain Vanilla bonds (called ‘greenium’) especially in the secondary market due to the expectation that companies investing in projects beneficial to the environment have an intrinsic lower credit risk.

Italian GSS bond issuers benefit from very competitive interest rates. From the chart above it can be observed that 41% of the volumes at the issue date was priced between 0.5% and 1.5% while 53% is within the 1.5% mark. The EUR8.3bn sovereign issue was placed at 0.75%; utilities and large caps issued below 0.5% and energy company ENEL accounted for around 50% of that volume.

Long-dated Instruments

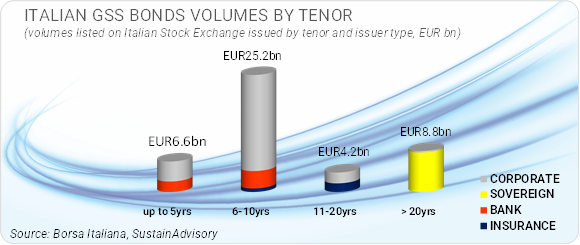

70% of bond volumes have a tenor of up to 10 years with 56% of volume between 5 and 10 years that are largely dominated by non financial corporates. The longest tenor is 24 years and the record goes to Italy’s sovereign bond that is due in 2045. Insurance companies’ bonds also show a very long date profile, all issued from 8 to 20 years.

External Review

100% of outstanding Italian GSS bonds are accompanied by an external review; this proves a high degree of transparency of issuers but also a best practice showing investors’ commitment to minimize the risk of greenwashing. The most common type of external review is the Second Party Opinion that according to ICMA’s definition is an assessment of the alignment of the issuer’s green, social, sustainability or sustainability-linked bond issuance/framework/program with the relevant Principles[1]. Other types of external review that are generally utilized are Assurances, Verifications, Scoring/Ratings.

[1] See ICMA Guidelines-for-GreenSocialSustainability-and-Sustainability-Linked-Bonds-External-Reviews-February-2021-170221.pdf (icmagroup.org)