Green, social and sustainability-linked bond issuance in the first quarter of 2022 in the Italian market reached EUR6.1bn, around a third of the volumes in 1Q21 which exceeded EUR17bn thanks to the listing of the sovereign green bond issue. Corporate issuers in 1Q22 doubled compared to the same period in 2021, overall, the number of issuers increased by 50%.

Sustainability-Linked vs Green Bonds

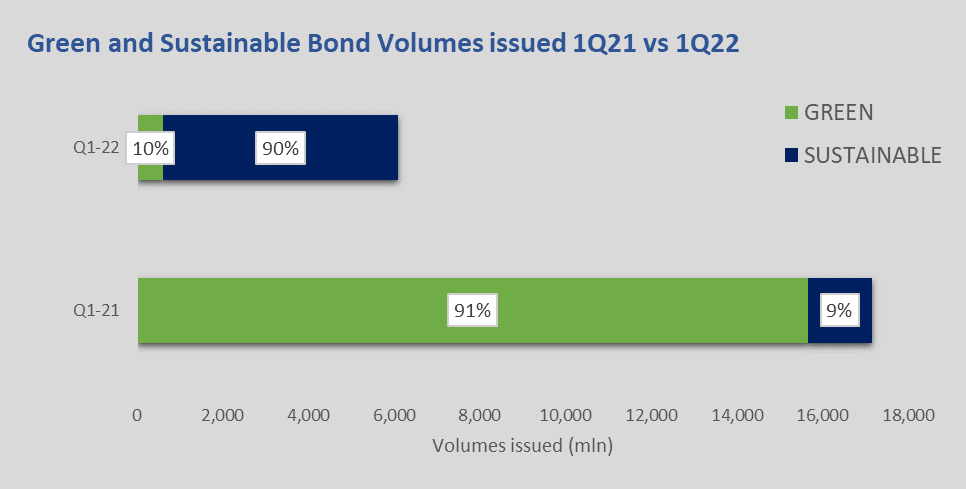

The upward trend in Sustainability-Linked bond volumes continued in the first quarter of 2022, with 90% of volumes issued and listed on Borsa Italiana (equivalent to EUR5.5bn), reversing the composition of issues compared to 1Q21 when Sustainability-Linked volumes reached just 9% of the total in the quarter.

This trend was largely anticipated by the growth seen in the second half of 2021: at the end of the year, Sustainability-linked volumes reached 35% of total volumes for the year, totalling EUR11.4bn.

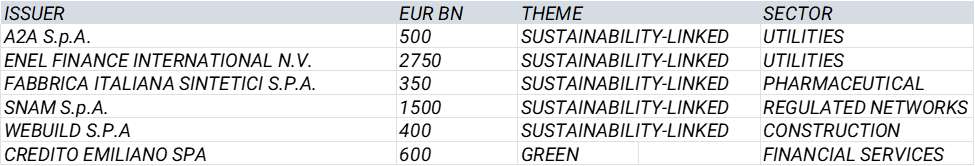

1Q22 Issuers

What are Sustainability-Linked Bonds?

Unlike green bonds, Sustainability-Linked Bonds do not aim to finance a specific project or investment, but are intended for the overall financing of the issuer who has set out sustainability targets (Key Performance Indicators – KPIs) upon the achievement of which the financial conditions of the bond improve. Thus, the interest rate may improve, worsen, or remain stable depending on whether the issuer at a certain date has fulfilled the conditions to which it had committed itself with investors.

Key Performance Indicators

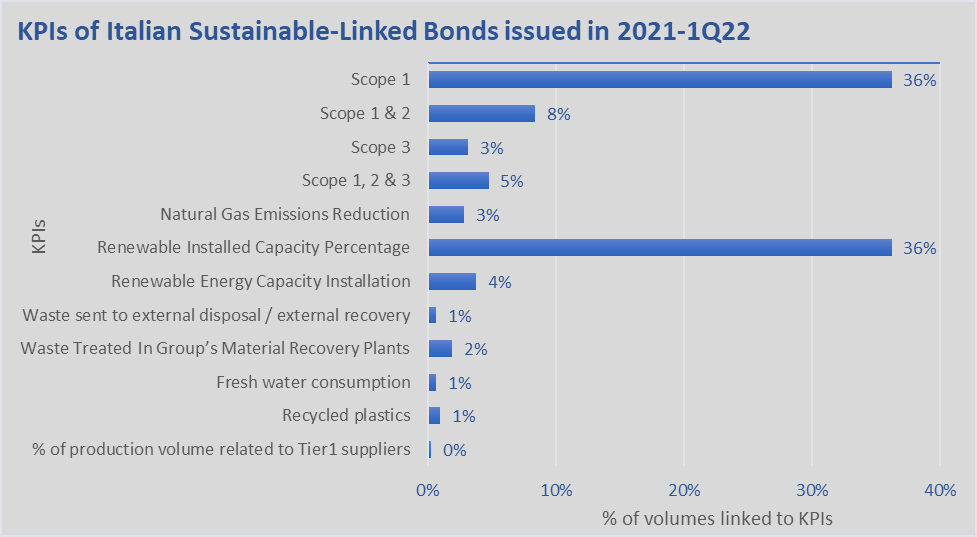

SustainAdvisory analysed the most recurrent KPIs set by Italian issuers in the context of Sustainability-Linked instruments issuance in the period 2021-1Q22.

As can be seen from the graph, the most commonly used KPIs relate to the reduction of direct greenhouse gas (GHG) emissions (Scope 1), to which is allocated around EUR 13.8bn of volume issued, and the increase in installed capacity from renewable sources both in percentage and absolute value (megawatts installed) for an amount allocated of c. EUR 15.3bn. This is followed, but with a very wide gap, by the reduction of direct and indirect greenhouse gas emissions (Scope 1&2) and the reduction of natural gas emissions. There are also objectives related to the management of industrial waste that is treated in recovery/recycling plants.

The market according to the Climate Bond Initiative

The success of Sustainability-Linked Bonds (SLBs) is not just an Italian phenomenon, quite the contrary. At European level, according to Climate Bond Initiative (CBI) data, SLBs in 2021 grew by 74% compared to 2020, while at global level the most significant boost was recorded in 2020 with volumes more than doubled compared to 2019, issued mainly by development banks. According to CBI at the end of 2021, the cumulative volume of SLBs exceeded USD 520bn on a global basis.

Effectiveness vs Ambition

Many consider Sustainability-Linked Bonds to be a more flexible instrument than ‘Green’ bonds because they are not linked to a specific project but to a broader strategy of the issuer to achieve sustainable objectives. However, it should be emphasised that failure to meet the targets is sanctioned only by an increase in the interest rate, while there are no additional elements forcing the funds raised by the issue to be used for investments identified as contributing to the sustainable objectives. In other words, the underlying commitments of SLBs are not sufficiently binding on the use of funds as in the case of green bonds. This is perceived as a limitation of the instrument. SustainAdvisory notes that the element of flexibility may determine the future success of SLBs to the extent that investors will be able to verify, through reporting and certification, that the objectives have been achieved. This ex-ante assessment can be made on the basis of the ambition of the targets set by the issuer and the calibration of the performance indicators (KPIs), which is also a key activity performed by external reviewers.

SustainAdvisory srl – We assist investors in assessing the actual impact of green financial instruments by acting as External Reviewer/ Verifier against the most widely used standards in the market. Our work is based on the principles of the Climate Bonds Initiative the ICMA – International Capital Market Association ‘s Green Bond Principles and the Global Reporting Initiative (GRI)

Our services include: External Verification of debt securities issued under the Climate Bond Initiative framework for which SustainAdvisory is an institution accredited as an Approved External Verifier.

Second Party Opinion: external review on debt securities intended to finance ‘green’, ‘social’ or ‘sustainable’ projects within the ICMA principles framework.